Save On Business Vehicles with Section 179 Deductions

At All Roads Ford Trucks, we're all about helping your business grow and thrive. There's nothing better than a capable vehicle ready to help you accomplish your daily needs. With Section 179, it's easy to save on vehicles used primarily for business purposes - at least 50 percent business use. Our finance team is happy to help you navigate business benefits to help you get the most for your money and acquire vehicles that are true investments in your company.

What Is Section 179

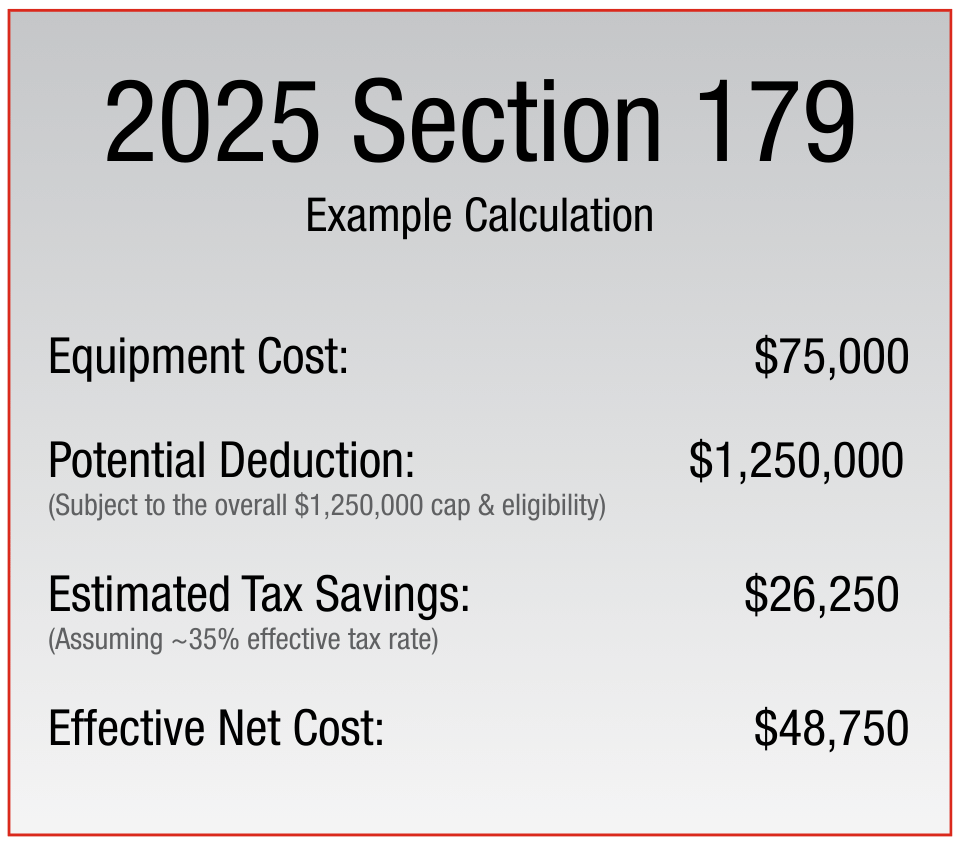

Section 179 is a provision in the IRS tax code for small to medium businesses that helps reduce the tax burden on equipment purchased for business needs. While most people associate equipment like printers, furniture, and office supplies with business purchases, vehicles count too.

Section 179 Vehicle Deduction Limits for 2025

- There is a general max deduction limit of $1,250,000 which starts to phase out at $3,130,000

- Passenger vehicles weighing less than or equal to 6,000 pounds: $20,000 cap

- Heavy SUVs weighing 6,001 to 14,000 pounds: up to $31,300 deduction plus bonus depreciation

- Work Trucks and Van weighing over 14,000 pounds: up to the full purchase price if used for at least 50 percent business use

- Bonus Depreciation was increased to 100 percent in 2025: allows you to deduct 100 percent of the remaining vehicle cost after applying the Section 179 deduction.

Which Ford Vehicles Qualify for Section 179 Deductions

Browse our new and used inventory and find high-quality vehicles that can qualify for Section 179.

- Ford F-450®

- Ford F-550®

- Ford F-600®

- Ford F-650®

- Ford F-750®

The amount of the deduction depends on the vehicle type and weight. Section 179 benefits also change every year, so be sure to purchase or lease your business-use vehicle by December 31, 2025, to take advantage of the current limits. For more information about Section 179 deductions, please contact our finance center at All Roads Ford Trucks in Upper Marlboro, MD.

How can we help?

* Indicates a required field